You’ve gone online to look at university websites, and you’re starting to receive those glossy college brochures in the mail. Maybe you have even set up appointments to visit some college campuses, but the big question on your mind and your family’s as well is, “How will we pay for college?”

At SPU, we are doing everything we can to make our private, nationally ranked education affordable for students. This past fall, we reduced undergraduate tuition by 25% and put a cap on future tuition increases.

We also help to award nearly $110 million each year in aid, and 95% of SPU undergraduates receive some form of financial assistance.

Here are some basic things to know about financial aid:

How is financial need calculated?

The Federal government has a formula they use to suggest what a family can afford to contribute to their student’s college education. Families fill out a form called the Free Application for Federal Student Aid (FAFSA), which gathers information about the income and expenses in the household where the student lives more than 50% of the year.

From that information, they calculate the Expected Family Contribution (EFC). EFC is the amount the government thinks parents and students can combine to pay for a year of college.

They do assume that the student will work, at least in the summers. The gap between the Cost of Attendance and the Expected Family Contribution is the family’s need.

When a student is accepted to SPU, our financial aid team will draw from FAFSA information and information you have submitted to create a personalized “Offer of Financial Assistance” for you.

Where does the aid come from?

Financial aid for post-secondary education can come from a variety of sources: Federal or State government, from SPU’s scholarship funds, non-profit organizations, scholarship foundations, and privately sponsored programs. FAFSA and SPU will help connect you with some of these available sources.

Awards may be based on financial need, merit, or a combination of the two. Merit means achievement or promise in one or more of the following categories: academics, athletics, fine or performing arts, leadership, or community service. You can find a list of available SPU scholarships here.

When do I fill out FAFSA?

The FAFSA form for the 2021-22 school year opened on Oct. 1, 2021.

What will I need to fill out these forms?

The FAFSA questions will be based on 2020’s taxes — the taxes that were due in April of this calendar year. The steps are straightforward and won’t take a lot of time.

Step One

Seniors and one parent* should each create a Federal Student Aid ID (FSA ID) – your digital signatures for FAFSA. It will take each of you about 10 minutes.

IMPORTANT: SAVE YOUR FSA ID AND CHALLENGE QUESTIONS IN A SAFE PLACE. This is not a one and done access. Students will use this same ID to submit FAFSA each year that they attend college. Parents will use this same ID for all of their children who attend college.

Use this link to create an FSA ID. You will need access to your cell phone and email during this process.

Need more help? This video can walk you through the FAFSA process.

*If parents have two separate households, this should be the parent with whom the student lives more than 50% of the time. You will report finances only for the household where the student lives more than 50% of the year. The word household is used because if that parent has remarried, it is the parent and current spouse’s combined income that is reported.

Step Two

Gather the documents needed to complete the FAFSA. You will need bank statements for the student and parents and investment records and untaxed income records for the student and parents. Tax information for the student and parents can be input from your records or by following prompts to link to the IRS website while you are filling out FAFSA. (This link is a great tool because it actually places the answers in the appropriate boxes automatically.) Even if you don’t submit your taxes electronically, this service will be available to you.

Step Three

It will take you about 40 minutes of students and parents filling this out together. Students should go here and sign on using his/her FSA ID. (The parent will use their FSA ID to sign documents at the end). Curious what the questions will look like? Use this pdf for a sneak peek.

Step Four

Be sure to print out your information at the end! Your confirmation page will have important information including your Expected Family Contribution (EFC) and information about any Federal grants or loans that are available to your family. A few days after submission you will get an email confirming your FAFSA was successfully submitted and summarizing the information you shared. This summary is called the SAR. Check it for accuracy & log back onto the FAFSA website to correct any errors right away.

I don’t have to commit to a college until May 1. Why am I filling out this information so soon?

While it’s true that many schools will post financial aid deadlines in the early spring, resources are finite. Aid is being offered as students qualify, so it helps to be at the front of the line.

Isn’t a private school like SPU more expensive than an in-state public school?

The In-State Matching Scholar Award is Seattle Pacific’s commitment to give high-achieving students a nationally ranked, private education — at a public school cost. Qualifying students’ SPU tuition and fees will be equal to or less than that of their home state’s flagship public university. You can find out more about this here.

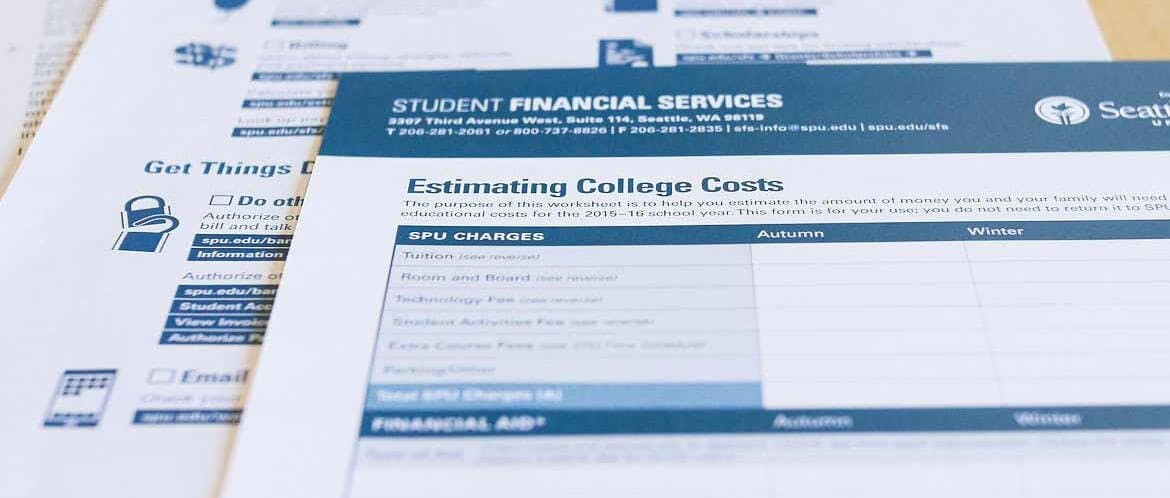

We are always happy to answer your questions at Student Financial Services. You can email us at sfs-info@spu.edu. (Please allow up to two business days for a response.) Or during typical business hours, you can call us at 206-281-2061.